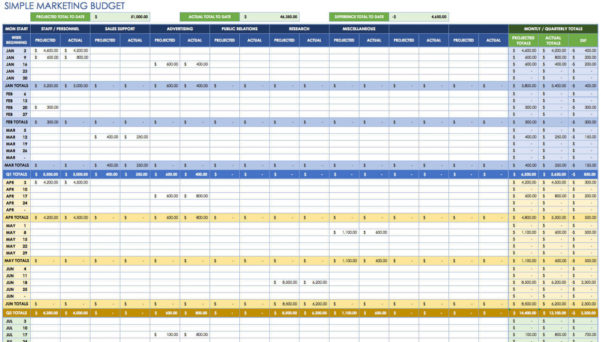

Overall, your expenses might be split into fixed costs such as:Īnd, variable business costs that could include: Alternatively, HMRC simplified expenses make claiming allowable business expenses easier for the self-employed using a flat rate, without the need to keep receipts. Step 2: Track your expensesĪvoid having to frantically go through all your receipts and bills just before the end of the financial year and start making regular entries on the spreadsheet tracker. If possible, try and calculate an average monthly income and adjust it accordingly. Therefore, tracking your business income, particularly if it’s an irregular income, is critical to know how much you can spend on expenses and unforeseen extras. Step 1: Track your earningsĪs most small business owners will agree, trying to calculate monthly earnings can fluctuate hugely. In contrast to when you have a payslip from an employer, running a self-employed business means that you’re the one in control of what goes in and out from your business bank account. Using a spreadsheet will enable you to see what you’re actually doing with your money. By doing this, you are establishing your financial goals for your business. When thinking of self-employed business accounting, especially for the first time, the first thing you should do is create a clear budget. Plus, it uses Excel or Google Sheets which means you don’t need to buy any expensive software. I’ve made it customisable so it will figure out the numbers specific to your business. This will make it easier to fill in your self-assessment tax return by using just one bookkeeping spreadsheet! Simply enter the numbers and it will automatically calculate your income, expenses and taxes. Here, you can track your income and expenses and how much tax you owe. To help you, I’ve created a Sole Trader Bookkeeping Spreadsheet. The easiest and simplest way to track your income and expenses is to use a spreadsheet tracker. Choose a routine that works for you, either weekly or monthly, or both, and more importantly, stick to it! It may not be something that we can master immediately and it takes practice, but improving on your accounting skills means a healthy financial journey for your future business. This might seem an obvious bit of advice, but finding a regular time to go through your income and self-employed expenses will be an enormous help in the long run. To help you understand this vital aspect of any business structure and use a bookkeeping spreadsheet, read on to find out more.

Self employed expense tracker how to#

How to track your income and expenses isn’t as difficult as it first might sound. Therefore, it’s important to stay on top of your business finances, despite everything else you have to do.

Either way, setting up a new business as a sole trader means that you are also the boss of your own payroll department. Are you someone who looks at your business accounting and thinks, ‘I can’t do this!’? Maybe you’re not great at Maths or the idea of bookkeeping makes your head spin.

0 kommentar(er)

0 kommentar(er)